From views to value: Performance-centric connected TV

Within the last five years, connected TV (CTV) has reshaped the advertising landscape, emerging as a game-changer for marketers. The instant accessibility and increased convenience it offers have led to a global surge in viewership, and the numbers continue to climb.

According to eMarketer, the CTV market will rise from $25 billion this year to $40 billion within four years, nearing two-thirds of the linear TV market. This transition is fueled on the audience side by changing consumer behavior, and on the ad revenue side by the large-scale shift from linear TV advertising to digitally connected TV.

The CTV opportunity is clear — now it’s time for marketers to look beyond its potential and start thinking about how to capitalize on the next phase in its progression, as CTV evolves from a top-of-funnel brand play to a bonafide measurable performance channel.

Back to basics: Understanding Connected TV

Before we dive into how marketers can make the most of the rise of CTV, let’s go over a rapid round of definitions.

- CTV – connected television: A category of devices where users can watch long-form, premium content delivered digitally (rather than via coaxial cable, satellite, or antenna) on a TV screen. Importantly, this is a household-level device, rather than a personal one – users can connect using an OTT “dongle” (like Roku or FireTV), a gaming console (such as Xbox or Playstation), or a smart TV with an operating system and app store.

- OTT – over the top: Any premium long-form content delivered via an app on a smart device — be it a TV, a mobile device, or a tablet. Popular OTT providers include Hulu, Netflix, and Peacock. Be careful not to confuse CTV and OTT: you watch OTT content on a CTV device.

- FAST – Free ad-supported television: Content that automatically plays on the TV screen or other devices (through mobile apps or the web) without being pre-selected by the viewer. FAST channels are powered by streamers and intended to mimic linear cable’s “always on” content. This market is predicted to grow to over $6 billion by 2025.

- AVOD – Ad-supported video on demand: Streaming content with ads. Think Hulu, Peacock, or Netflix ad tier. AVOD is different from the FAST inventory, as the content is selected on demand by the user. For example, you can choose to watch Yellowstone on the Paramount+ app with commercials.

Although all these terms might sound similar, it’s important to understand the differences between them – particularly when you consider the different engagement levels. For example, CTV might cater to multiple viewers in a room, whereas OTT can engage a single viewer in the palm of their hand.

As CTV exploded, streaming platforms like Roku, Hulu, and CTV demand-side advertising platforms saw unparalleled growth, as brand advertisers rushed in to capture share of voice.

Delivering outcomes: Not just for performance marketers

Advertisers keen on reaching an expanding consumer base are taking notice of CTV, with the appeal being crystal clear: CTV is a seamless blend of traditional TV and internet capabilities that has transformed TV into a new performance channel. Advertisers can now benefit from enhanced visibility, measurability, reduced costs, and superior audience targeting compared with linear TV.

And with the mobile space becoming increasingly saturated, CTV is now emerging as a promising new channel to diversify the media mix. Data from eMarketer shows that, while mobile remains dominant, CTV is narrowing the gap, with both channels set to capture more than three-quarters of US digital time spent in 2023. Moreover, it’s expected that by 2024, there will be 115.1 million CTV households with 1.1 billion CTV devices in use worldwide. And it’s not just the number of users: the global ad revenue from CTV is projected to add 10.4% between 2023 and 2028, amassing $25.9 billion in 2023.

Prominent players like Roku, Hulu, and YouTube TV have built thriving advertising businesses in this space, putting pressure on others to use this channel to sustain and grow their user base.

Traditionally, brand reach has been the focal point of CTV advertising, aligning closely with linear TV buying strategies. But now, advertisers are looking to reshape their measurement for CTV and focus more on performance and measurable outcomes. As investments in what were traditionally deemed “premium” channels grow, the focus on clear ROI and precise performance metrics becomes increasingly important.

Historically, TV buying prioritized premium shows like “Friends”, where the cost of a 30-second slot was significantly higher due to the broad viewership. However, as CTV allowed for one-on-one targeting, the industry has begun to evolve to prioritize performance over mere eyeball counts. For advertisers to attain maximum, measurable ROI for their ad spend, the attention needs to shift from impressions to conversions.

CTV 2.0: What’s next for connected television

Before charting the future of CTV, let’s first look back at the evolution of digital marketing for some clues into what might lie ahead.

Since the advent of the internet and the dawn of digital marketing, every channel — from desktop display to online video (first on desktop, then on mobile) to mobile in-app — has gone through three phases:

- Nascency: A new, exciting channel emerges, and advertisers explore and test its potential.

- Inventory supply surge: Seeing the potential for unparalleled revenue growth, many suppliers, publishers, and exchanges actively rush to capitalize on this newly developed channel to capture incremental growth opportunities.

- Performance differentiation: With supply saturation, differentiation on content alone becomes increasingly difficult. As supply becomes more commodified, marketers must differentiate not on the content or context but on measurable business impact. Enter, performance.

CTV is following this same trajectory. Just over half a decade ago, CTV was in the first nascency stage with just a handful of publishers (including Hulu and Roku) owning the majority of the small, but rapidly growing market. However, over the last two years, CTV has progressed from nascency into the second phase: supply proliferation. Many new providers have entered the market and existing providers have expanded their offerings.

Nowhere was this more obvious than during the so-called streaming wars, where major broadcasters and media companies launched their own version of “Plus” streaming apps — Disney+, Paramount+, Peacock, Apple TV+, Discovery+, and HBO Max (now Max, post-Warner Bros. and Discovery merger). Even Netflix – which had sworn to stay ad-free forever – has made the leap into the ad-supported ecosystem.

The advent of FAST channels in addition to existing AVOD inventory (remember, this is “autoplay” CTV inventory) further expanded supply. As streaming losses continue to pile up, the transition from subscription-only CTV to advertiser-supported CTV reveals an unprecedented increase in supply and indicates a shift toward performance-based advertising.

As supply continues to come online, we’re entering the performance phase of CTV. Recognizing this, advertisers should proactively adapt their strategies to lean into performance-based advertising.

Setup for performance-centric CTV

CTV is not only an opportunity – it’s becoming a necessity in the advertising ecosystem. To thrive in the third phase of performance differentiation, advertisers need to:

- Get both brand and performance: Marketers are already spending on CTV, so why not get more bang for the same buck? With the transition to performance underway, it’s important to shift focus from traditional brand metrics like impressions, reach, and frequency, into performance KPIs, like installs, conversions, and paying customers, as these are pivotal to driving measurable business growth.

- Implement robust measurement: A robust measurement framework that tracks conversions on a multi-viewer, more complex channel should be tailored to each marketer’s specific business. Whether the strategy leverages mobile measurement partners (MMPs), incrementality, media mix modeling, or some combination of the above, it’s important to define success metrics to measure performance methodically.

- Find the right fit in partnerships: Accurate targeting and efficient bidding are more critical now than ever. Human biases can overlook a huge part of the potential market, opting to target auto intenders, or women aged 18 to 35, when, in fact, the target customer may live outside the traditional marketing mold. Finding that customer can feel like pinpointing a needle in a haystack. And that’s exactly where advanced operational machine learning excels.

The numbers don’t lie: 2023 trends indicate a bright future

Thanks to CTV’s democratizing effect on ad spend, TV advertising isn’t just for big-budget brands with deep pockets anymore. CTV is now both a measurable and affordable performance channel that offers mobile apps a great opportunity to drive growth. And with brands already starting to implement strategies that leverage CTV and mobile in tandem, tangible results have begun to emerge.

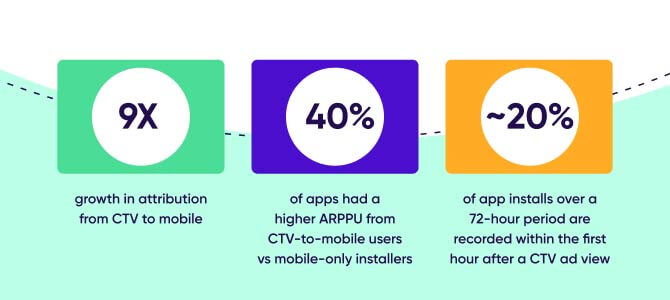

To help marketers make the most of the powerful CTV-mobile duo, AppsFlyer’s industry-first CTV-to-mobile report provides actual growth and performance numbers for this emerging channel. Some of the key findings include:

- 9X growth in attribution from CTV to mobile between the months of February and October 2023. Demonstrating widespread growth, the average per-app figure also jumped 2.5 times. Beyond installs, 18% of CTV attributions also had a CTV assist, outperforming the 5% mobile-only assist rate.

- 40% of apps had a higher ARPPU (average revenue per paying user) from CTV-to-mobile users vs mobile-only installers – no less than +56% on average. This is a promising result, considering the limited knowledge and data in this new channel. ARPPU from mobile-only campaigns still maintains a slight edge at 9%.

- Approximately 20% of app installs over a 72-hour period are recorded within the first hour after a CTV ad view, although engagement remains steady throughout the three days. Within the first hour, 18% of installs occur in the first five minutes – demonstrating the importance of commercial breaks to drive action.

CTV strategy in action: Rush Royale

With over 40 million downloads on Google Play and 15+ million downloads on iOS, Rush Royale, Tower Defense’s flagship mobile game, is one of the most popular gaming titles in the world. In their quest to become the world’s leading gaming app, the Rush Royale team was looking to test new channels to scale their user base, while gaining a better understanding of their return on ad spend (ROAS).

After seeing strong results on Moloco Cloud DSP, Rush Royale wanted to leverage Moloco’s CTV inventory to acquire even more quality users. By devising a focused campaign strategy for CTV, they exceeded their ROAS target by 180%, achieved a 70% more efficient cost per install (CPI), and secured a 27% better CPI than that of their mobile counterpart.

Rush Royale also used AppsFlyer’s CTV-to-mobile measurement solution, which gave them insight into their ad performance by measuring installs and post-install in-app events. They also incorporated QR codes into their CTV ads with AppsFlyer’s OneLink deep linking technology, which directed ad viewers to either download the app in the right app store if they hadn’t already, or to the right place within the app if they already had it installed.

The final word

CTV is no longer just the marketing trend du jour; it has quickly become an integral part of almost every scaled advertiser’s marketing plan. As CTV begins to gain traction beyond the early adopters in the media and entertainment and mobile gaming industries, it’s clear that businesses of all kinds are looking to reap the benefits. With dollars increasingly flowing into this marketplace, savvy advertisers are thinking “What’s next?” Our answer is a resounding: performance is what’s next!